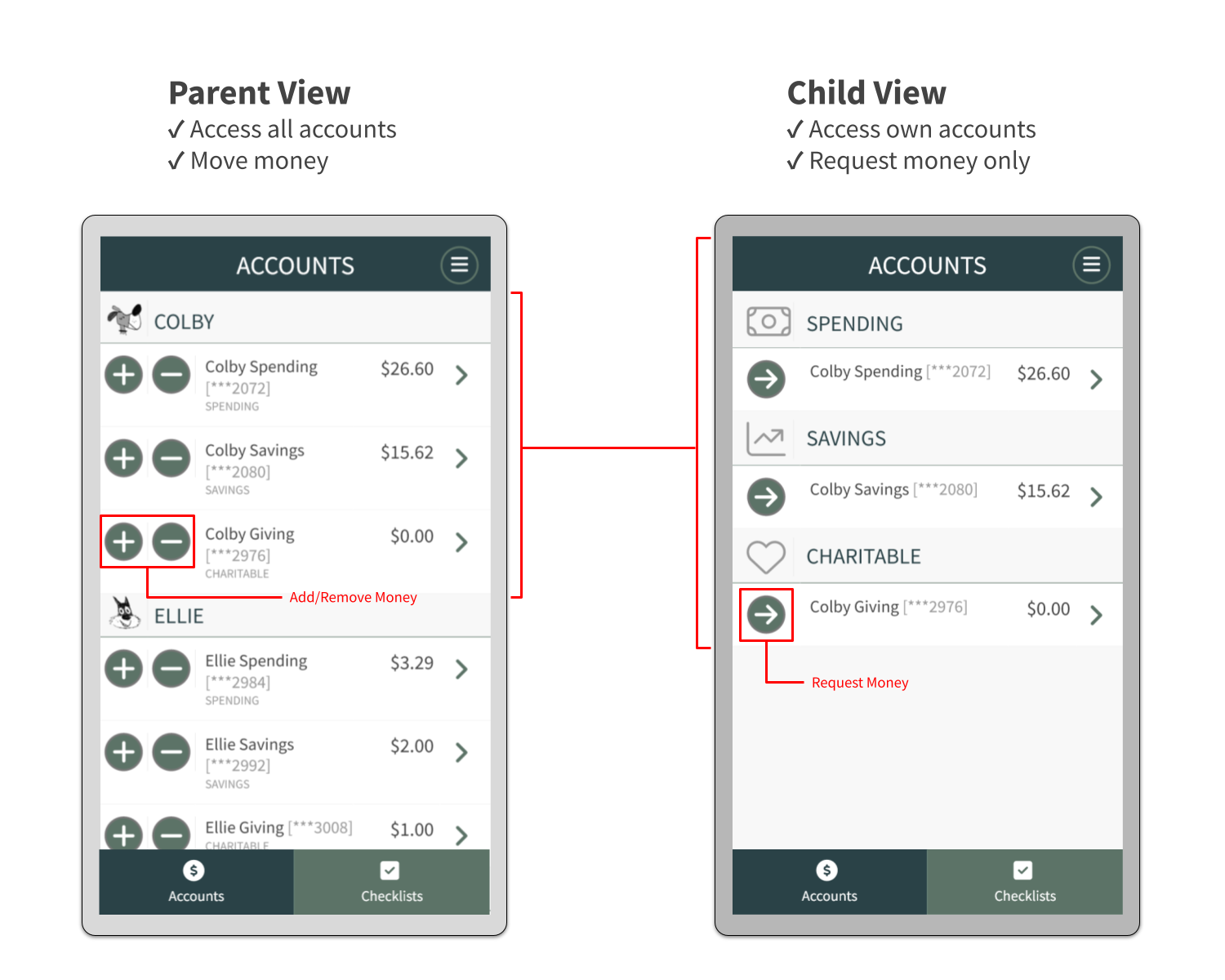

Parent/Child Roles

Parents control accounts and money rules. Kids see just their own accounts with controlled access.

Strike the right balance between autonomy and oversight

- Kids learn by doing.

- Parents make the money rules for earning and spending.

- Parents provide oversight and guidance.

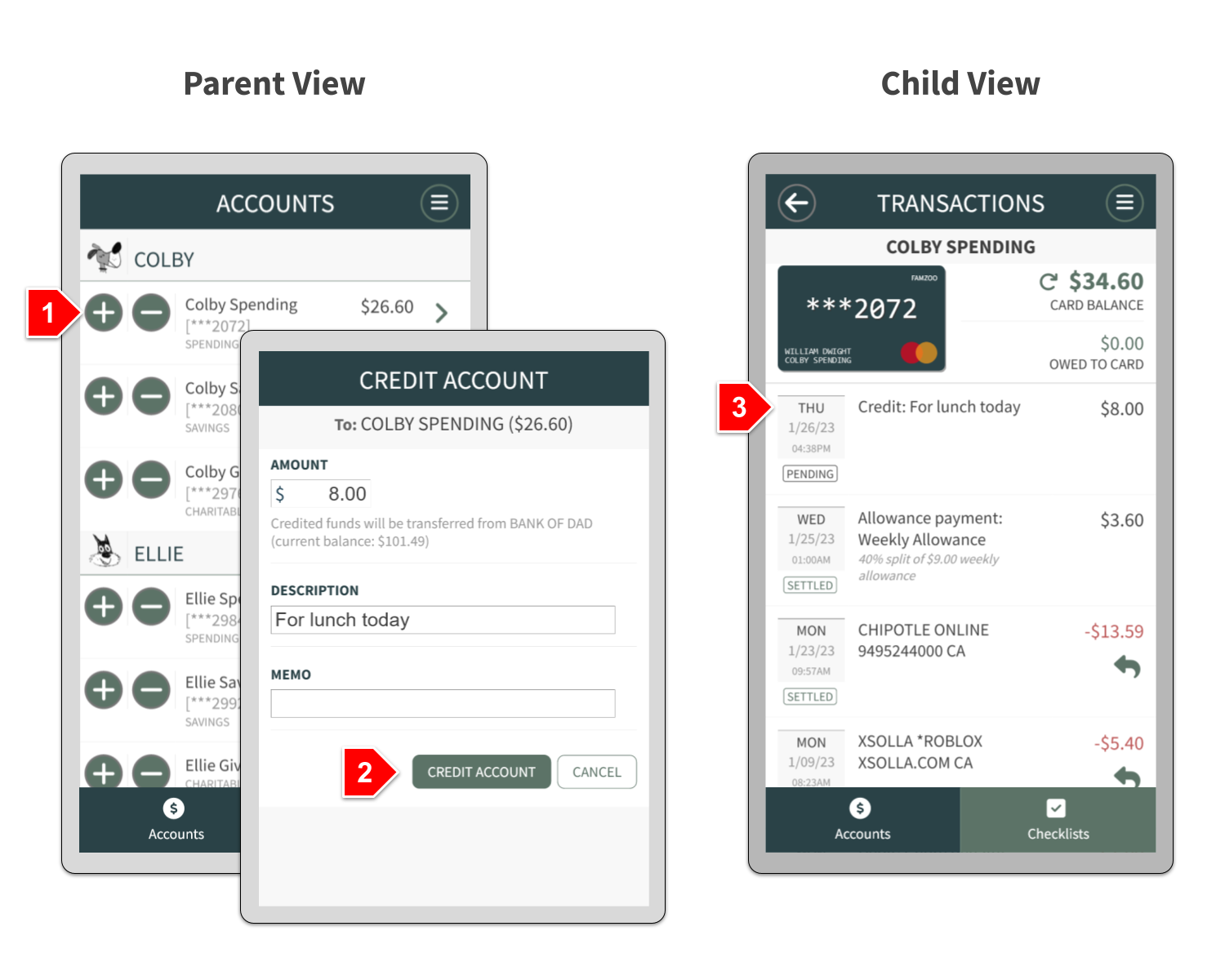

Instant Transfers

Move money instantly between family member cards.

Handle everyday money emergencies

- Get funds to a family member immediately. Anytime. Anywhere.

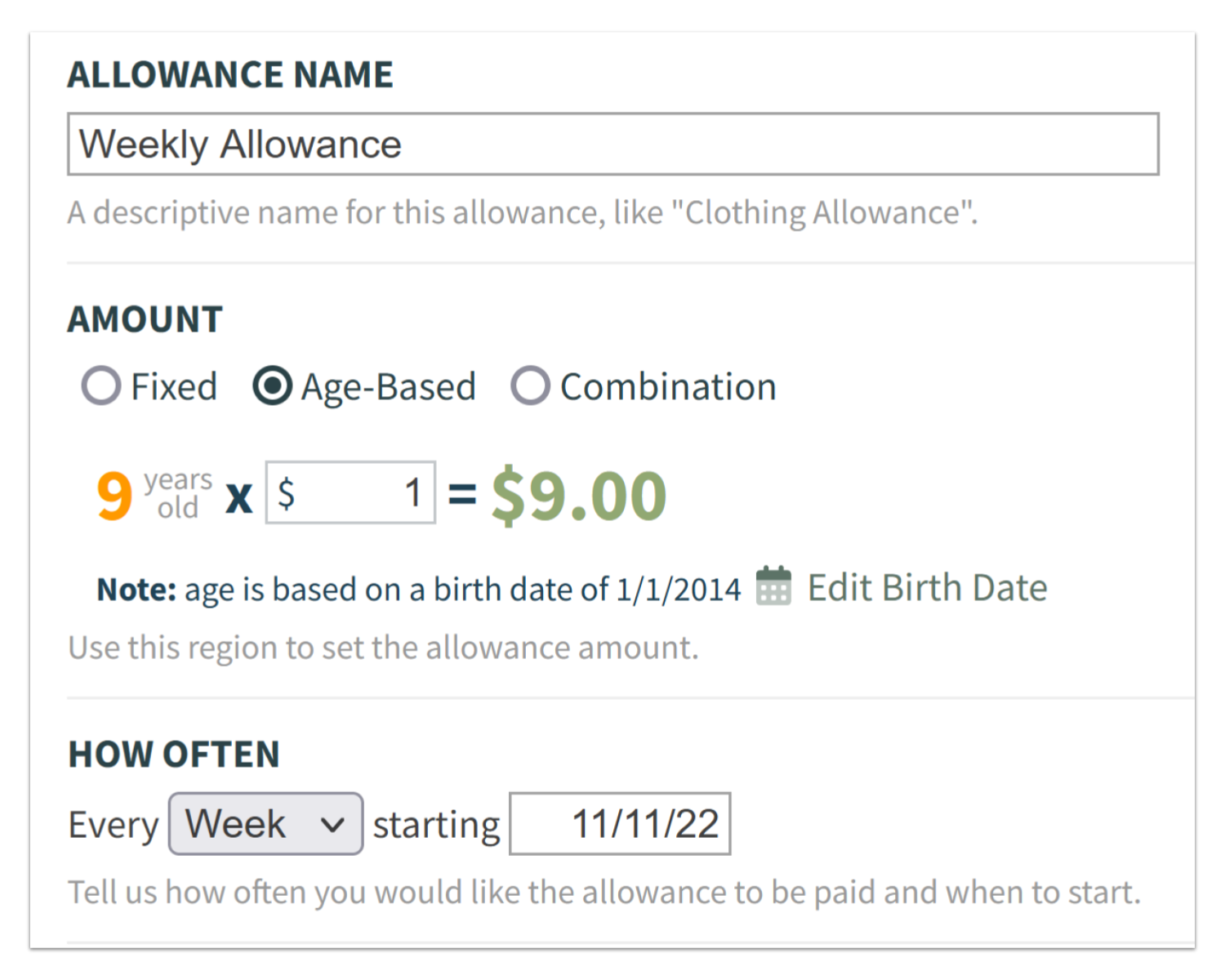

Scheduled Transfers

Automate recurring transfers between family member cards - e.g., allowance.

Model fiscal reliability

- Never miss another allowance payment.

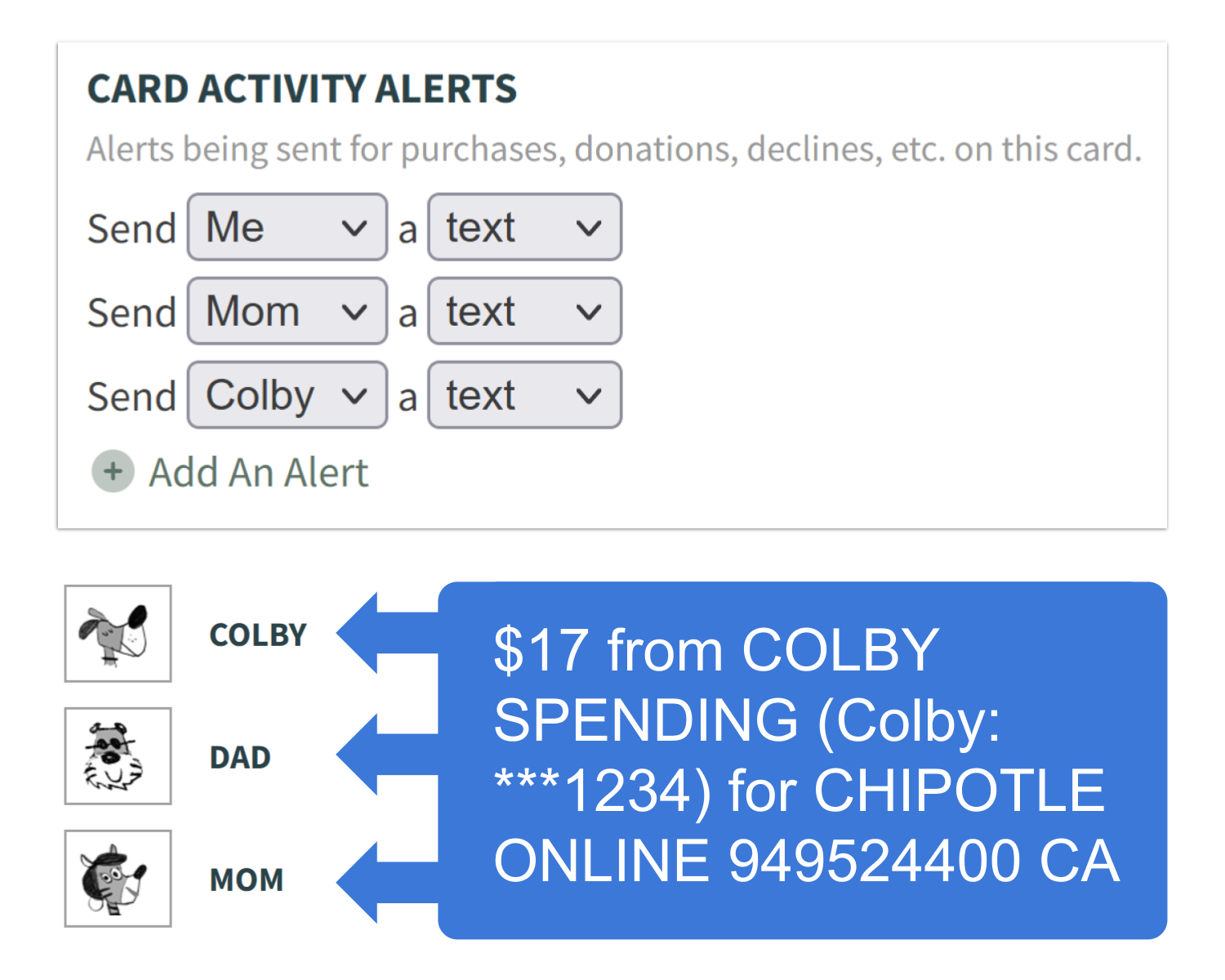

Activity Alerts

Alert parents and children about card activity and remaining balance in real time.

Stay vigilant

- Nip unauthorized transactions at the bud.

- Stay on budget (alerts include running balance).

- Maintain peace of mind for parents and accountability for kids.

- Prompt the cancellation of unexpected or unwanted subscriptions.

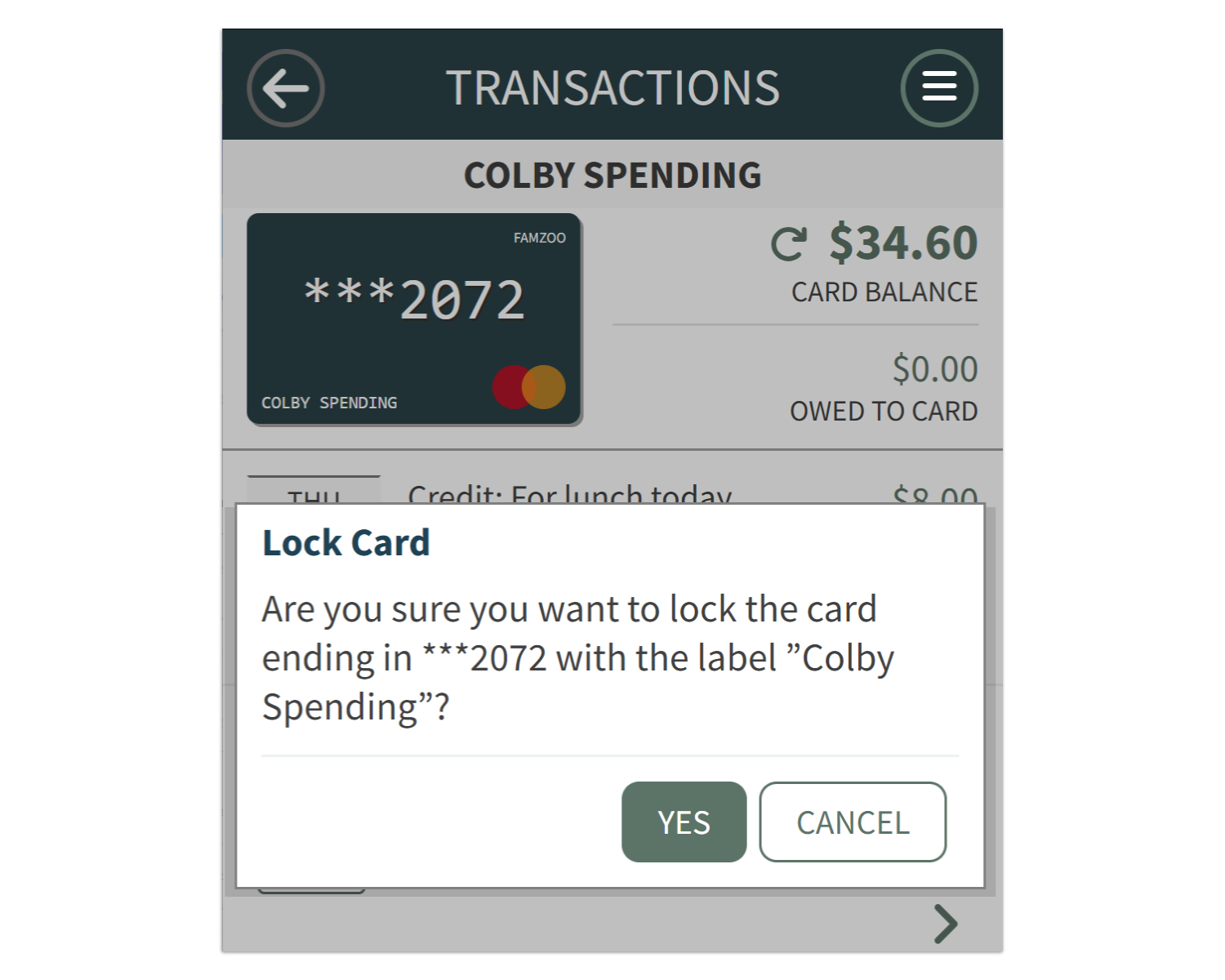

Lock/Unlock Card

Temporarily prevent use of card for protection or for a “financial time-out”.

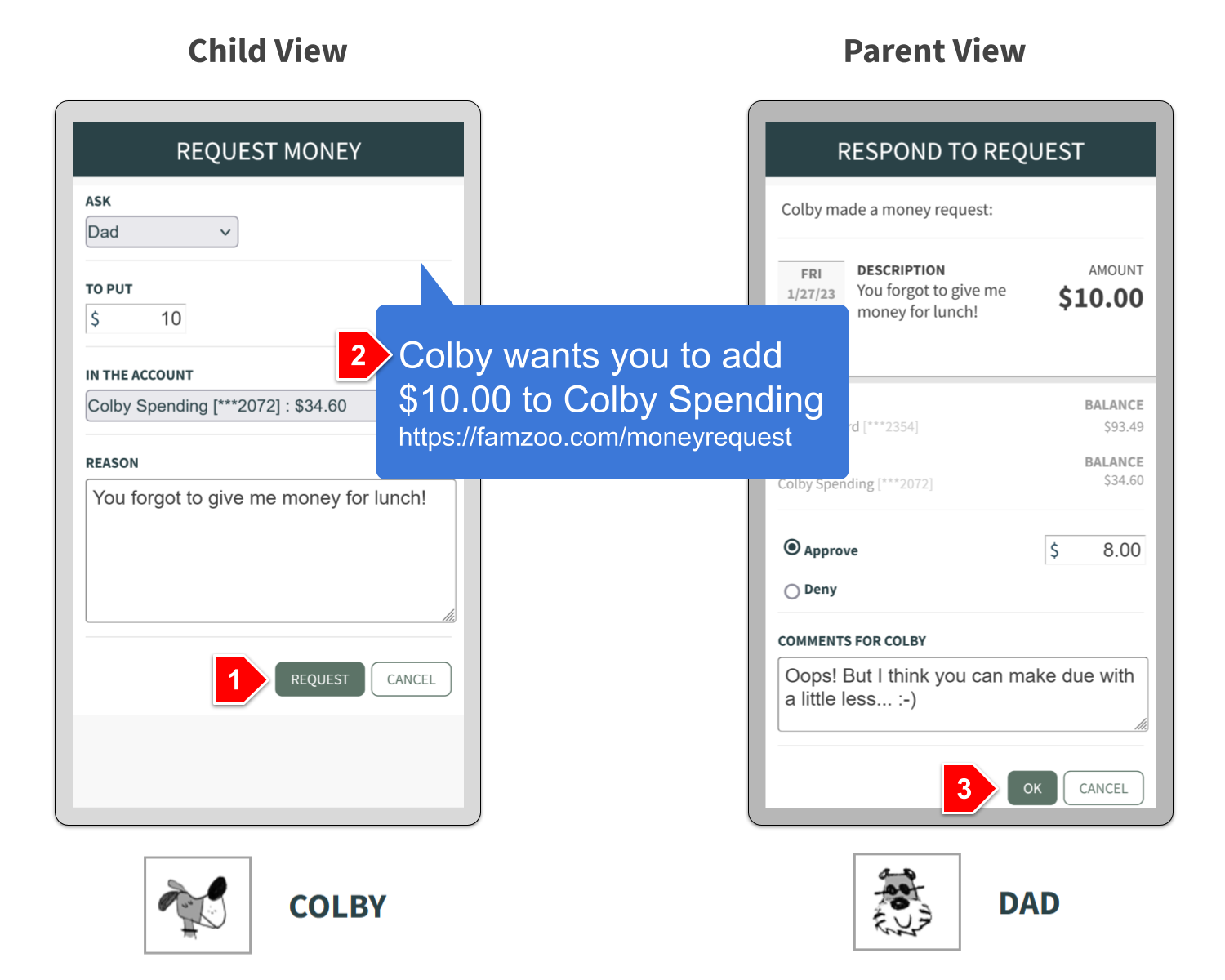

Money Requests

Automate approval and tracking of requests for money.

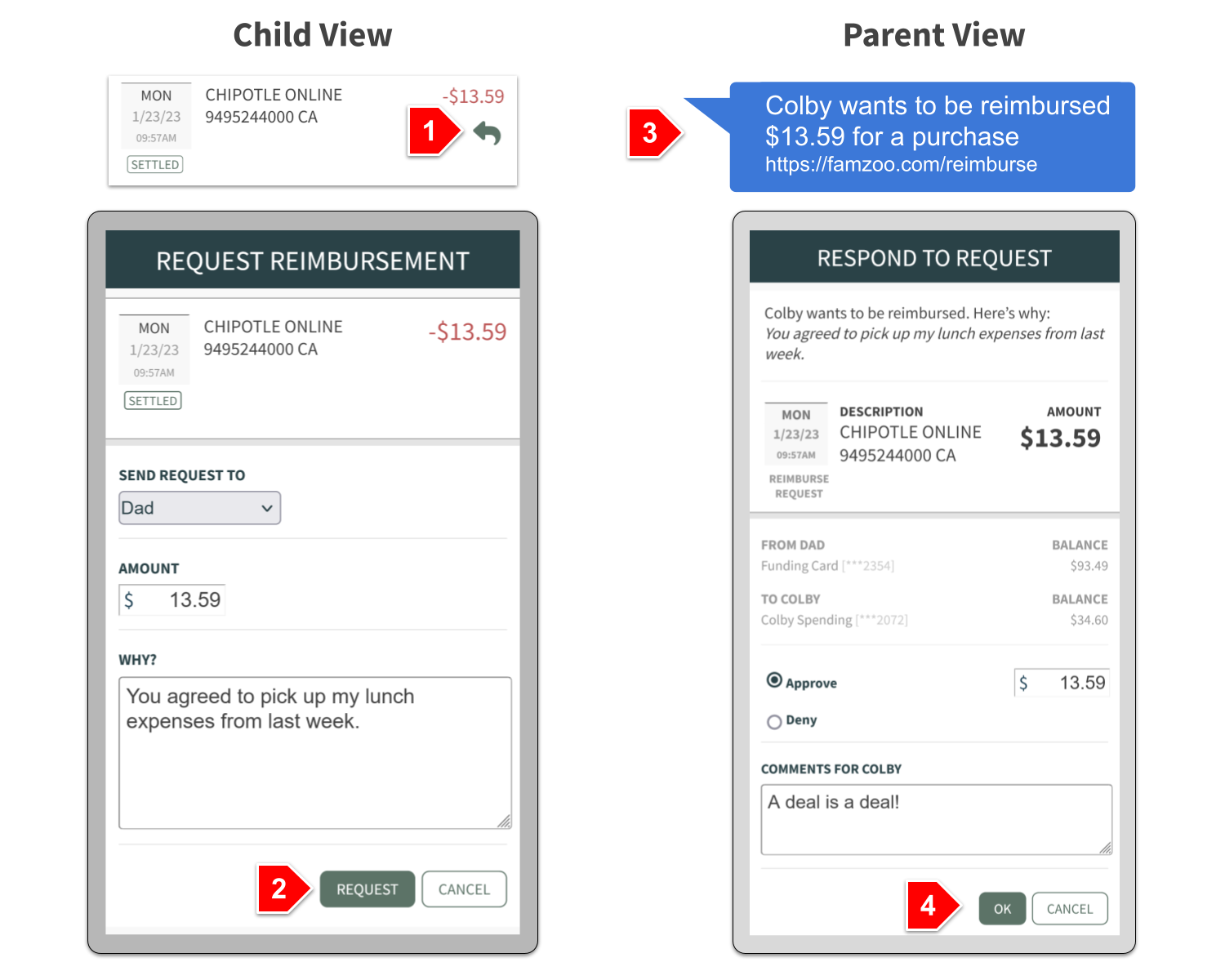

Reimbursements

Automate approval and tracking of expense reimbursement requests..

Raise cost conscious kids with a comfortable cushion

- Help kids appreciate the cost of everyday goods and services.

- Condition kids to maintain a healthy account balance cushion.

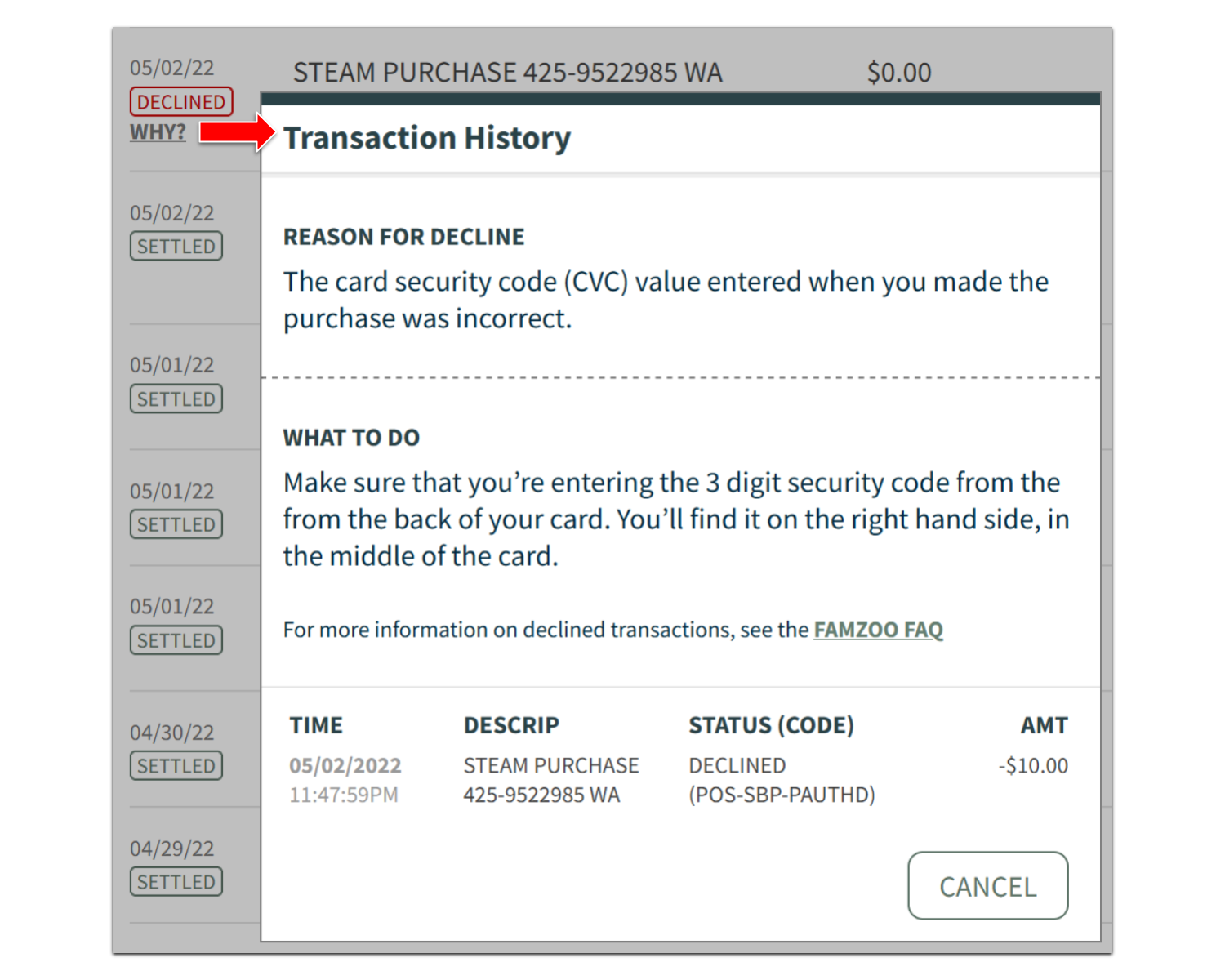

Detailed Decline Info

See specifics on why each decline occurs and what action to take.

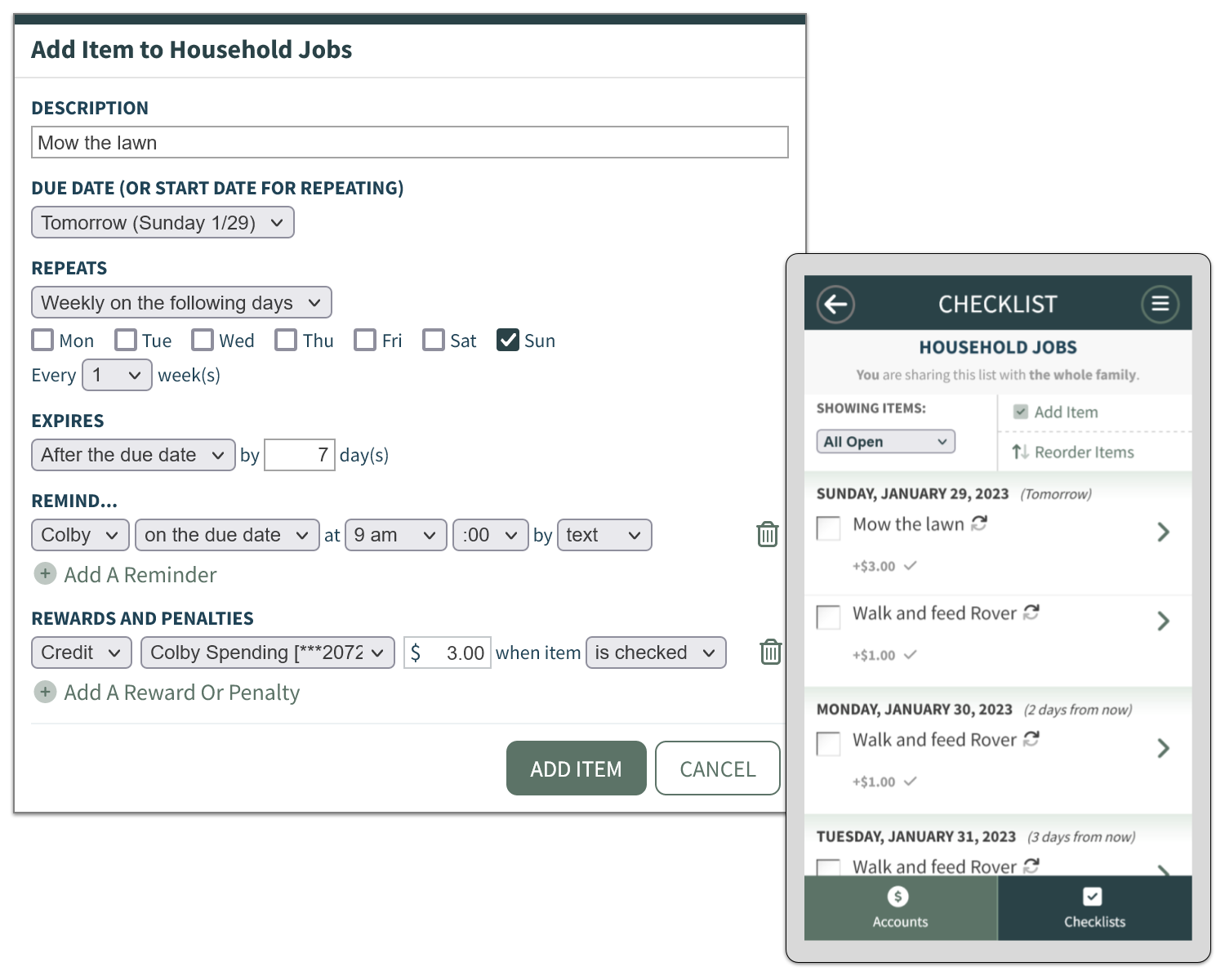

Payment Checklists

Schedule chores and odd jobs tied to rewards or penalties.

- Teach kids the value of a dollar and the connection between money and work.

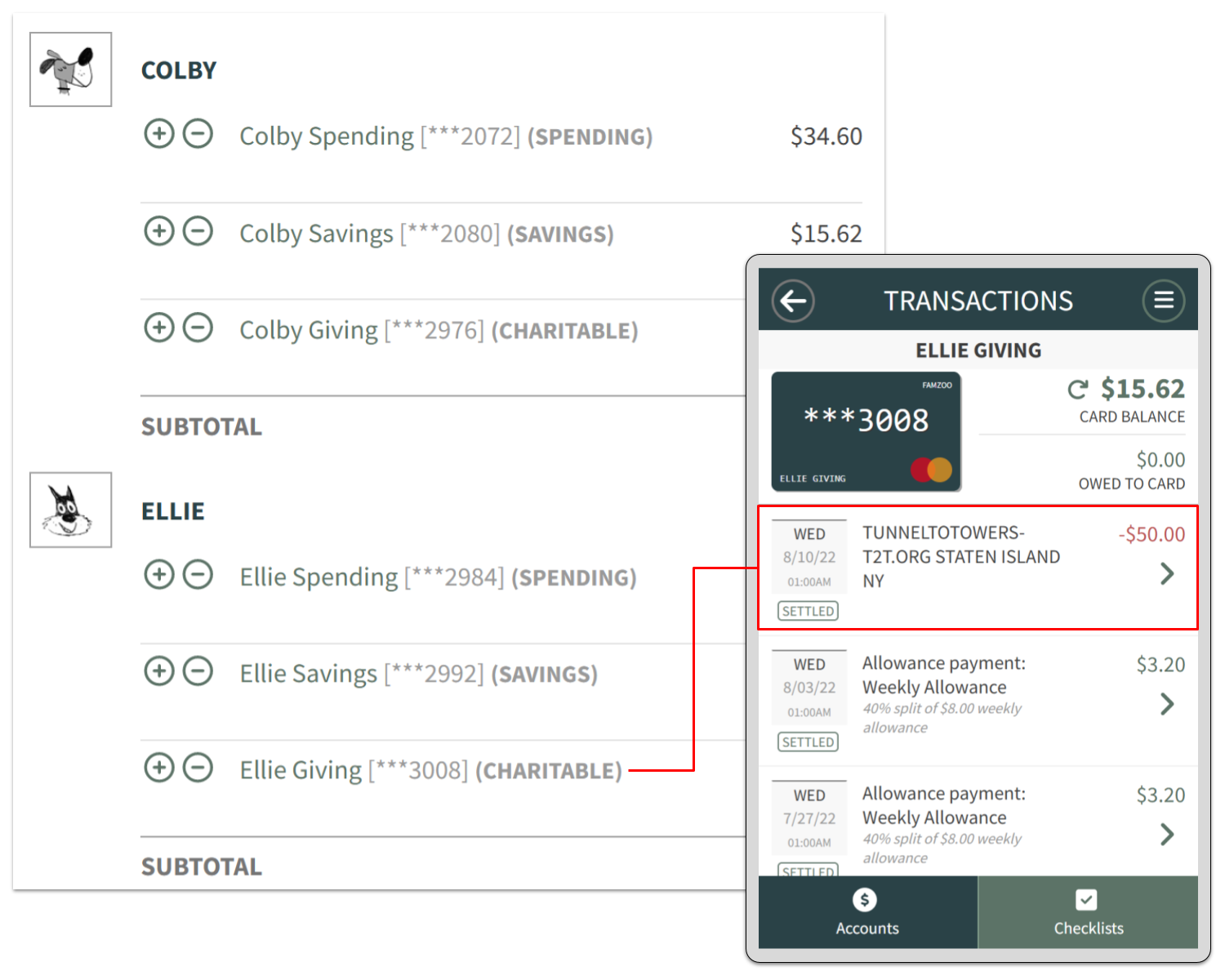

Spend, Save, Give Accounts

Separate funds into any number of purpose-driven subaccounts.

Give money a mission

- Teach kids to assign a purpose to each dollar with simple envelope budgeting.

- Encourage saving and philanthropy.

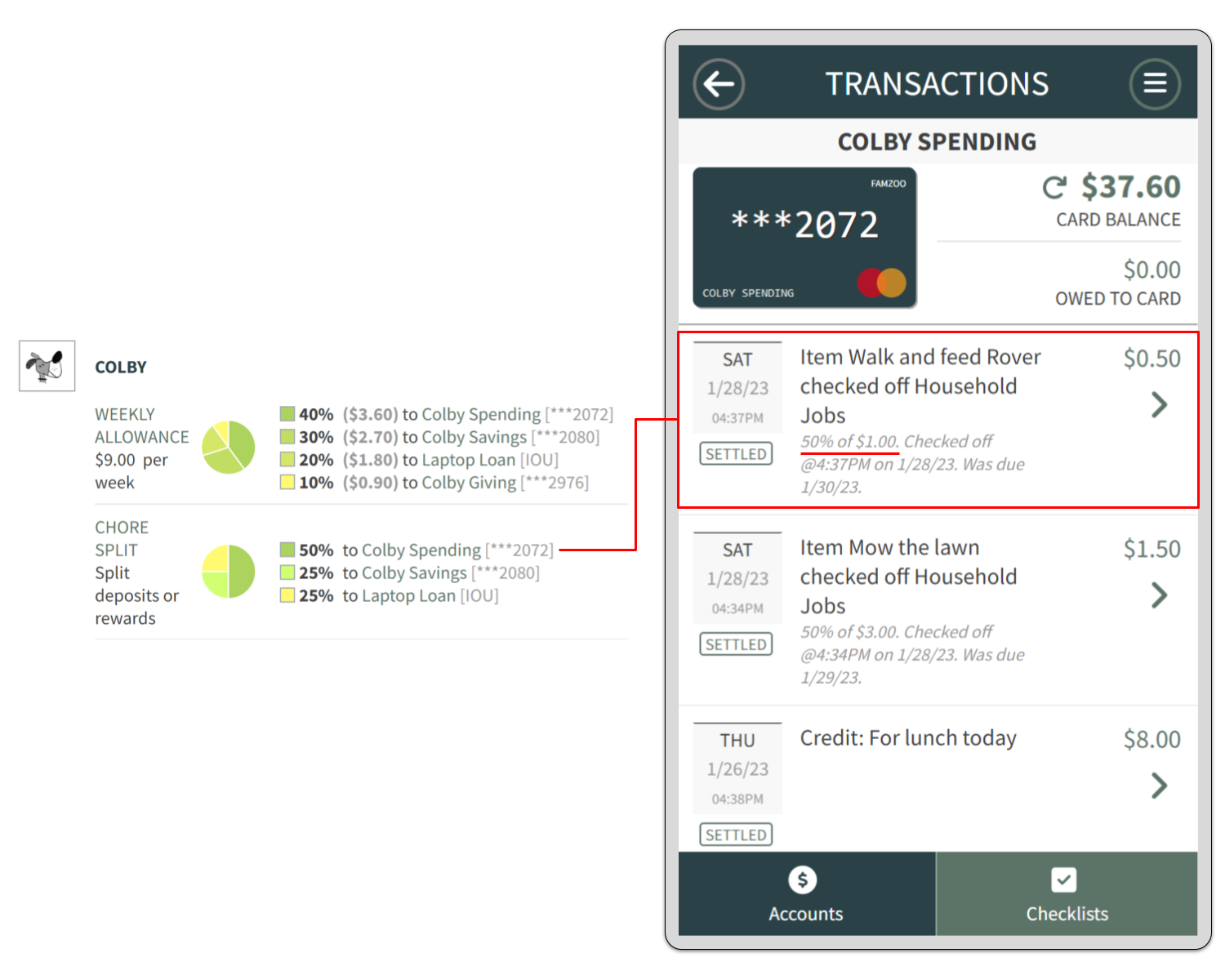

Payment Splits

Split payments for allowance, chores, odd jobs, etc. between multiple accounts.

Pay yourself and your community first!

- Teach kids to set aside funds for saving and giving before spending.

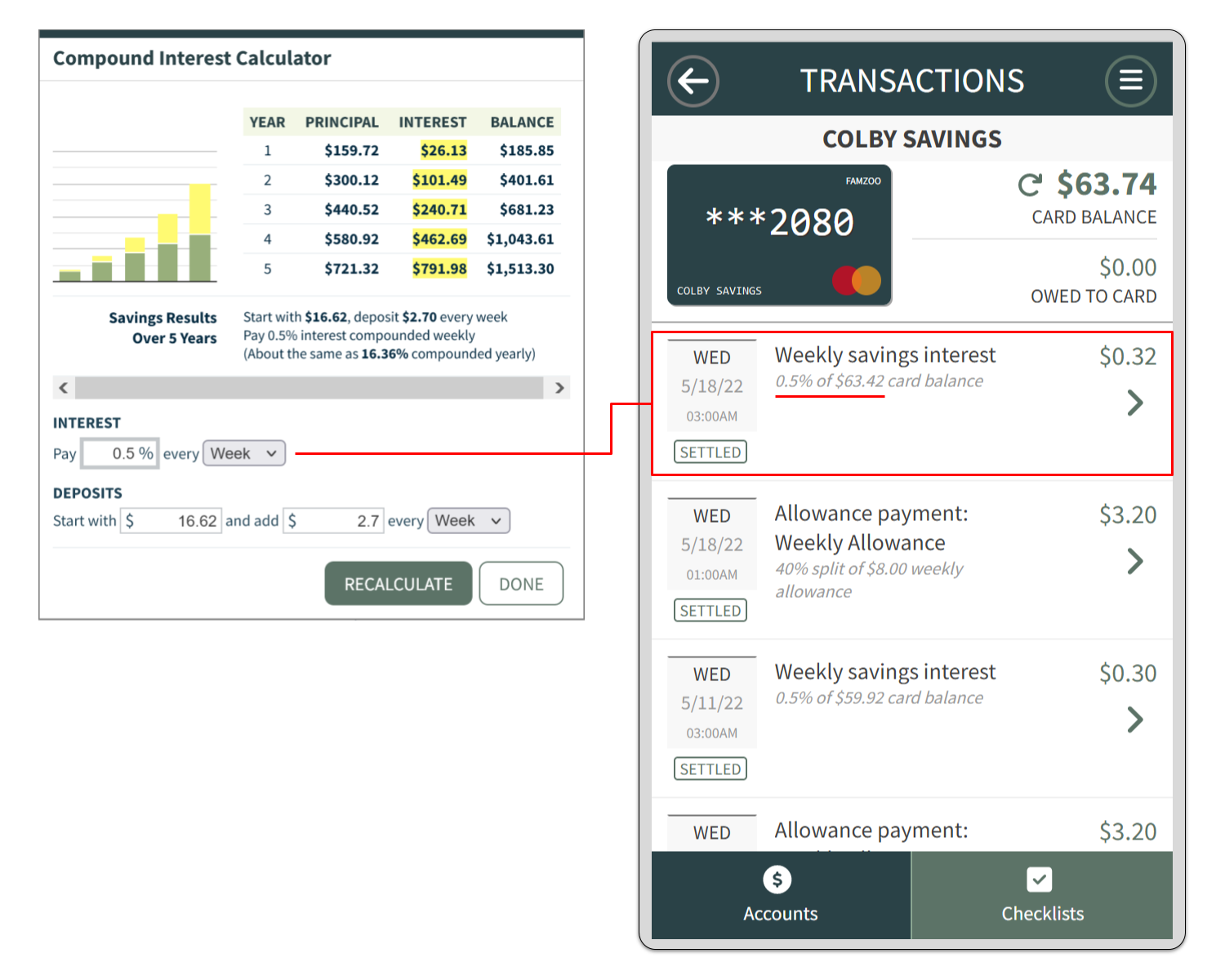

Parent-Paid Interest

Define and automatically pay your kids an “interesting” savings interest rate

- Teach kids the power of compound interest in a time-frame they can appreciate.

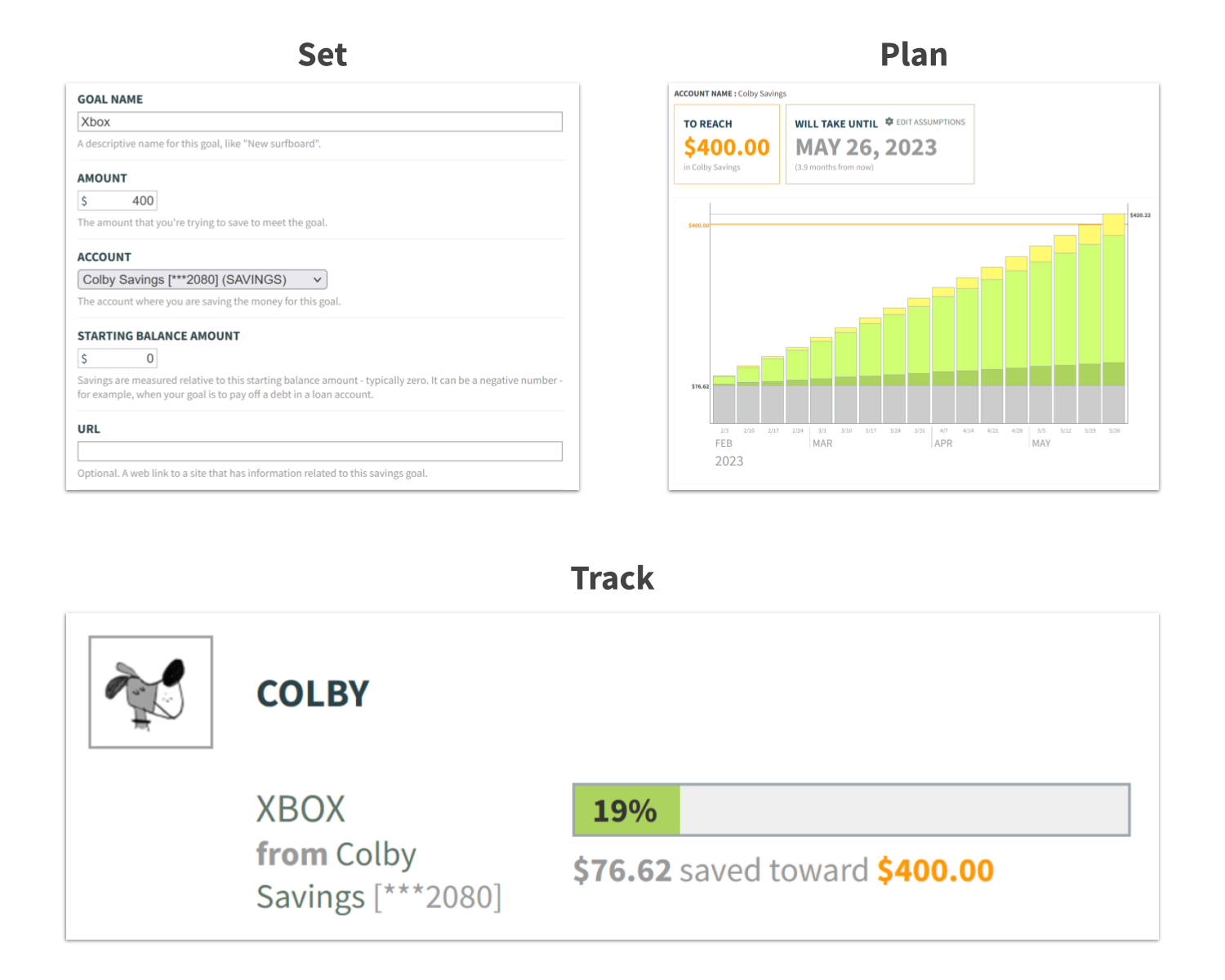

Savings Goals

Set savings goals, make savings projections, and track progress.

Delay gratification

- Teach kids to set, track, and achieve financial goals.

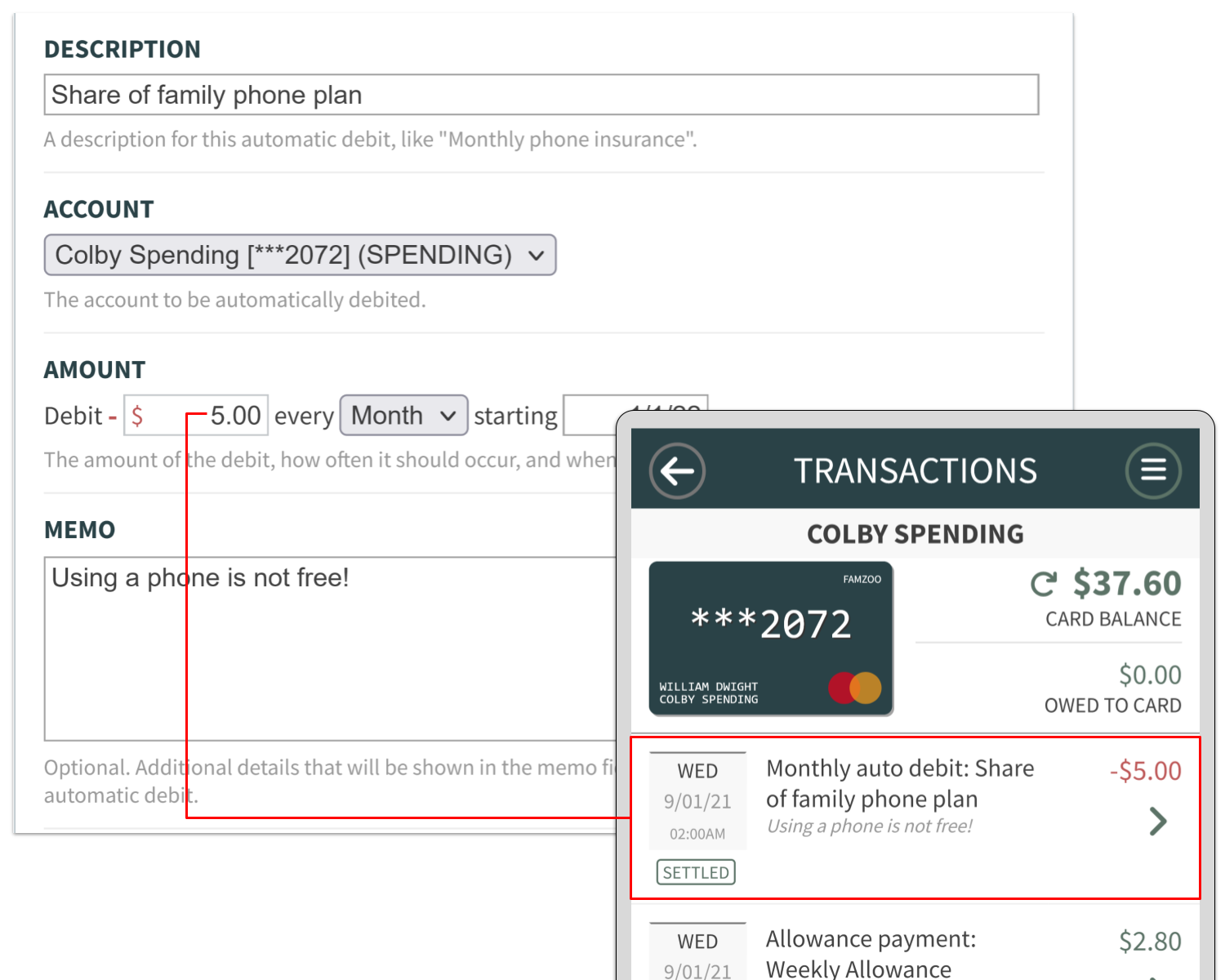

Family Billing

Schedule automated debits to charge kids for their share of recurring family expenses.

Family plans are not free plans!

- Teach kids that typical shared family services like phone plans are not free.

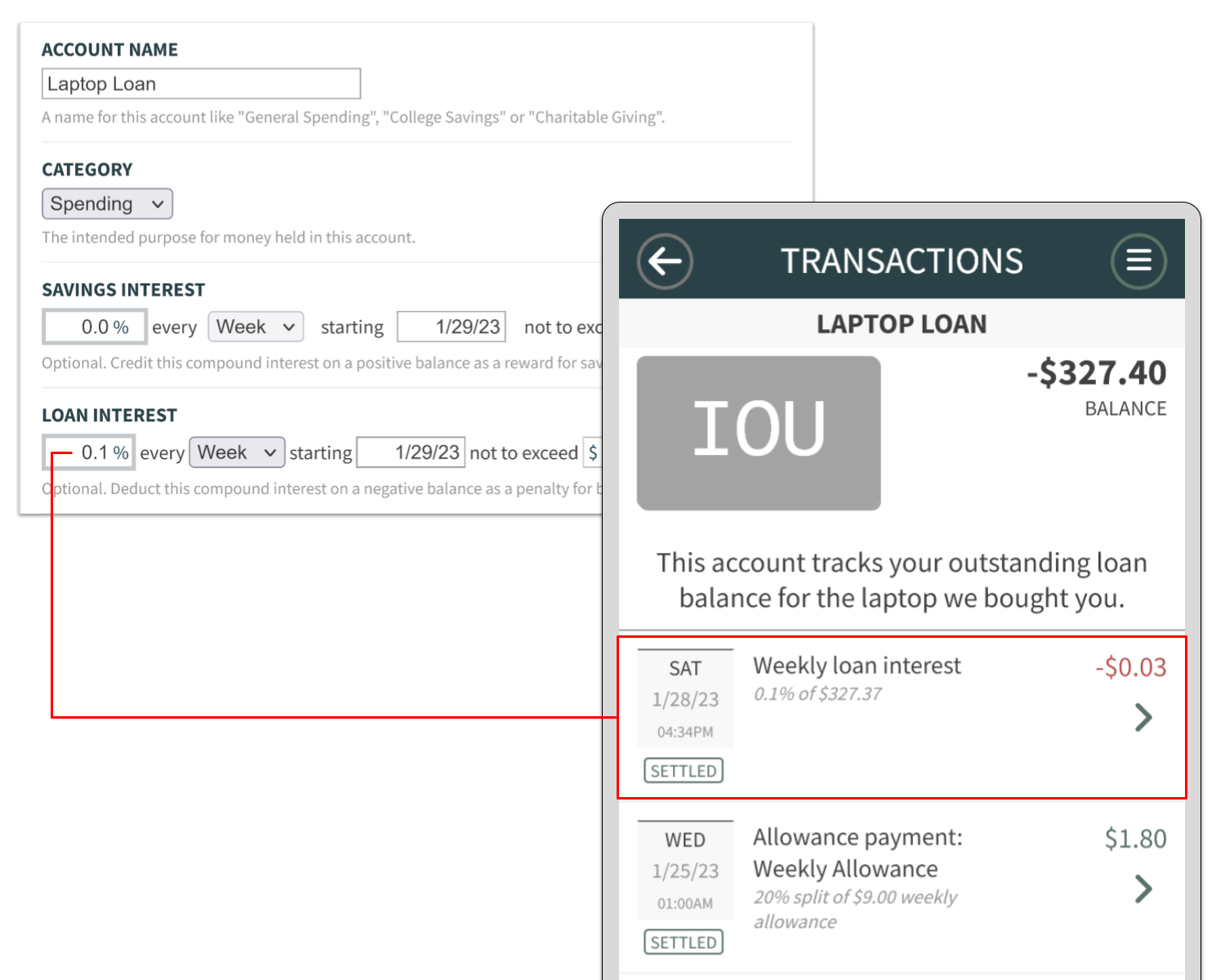

Informal Loan Tracking

Track the repayment of money loaned to kids with a parent-defined loan interest rate.

Debt hurts!

- Teach kids that borrowing money costs money and impacts other priorities.